Learn Financial Analysis from People Who've Done It

We run intensive analysis programs for professionals who want to understand how industries actually work. Not theory—real frameworks used by advisors and strategists across Australia.

Talk About Your GoalsMeet Your Instructors

Our programs are led by analysts and former executives who've spent years advising on mergers, valuations, and strategic planning. They know the difference between classroom concepts and what actually matters when you're presenting to stakeholders.

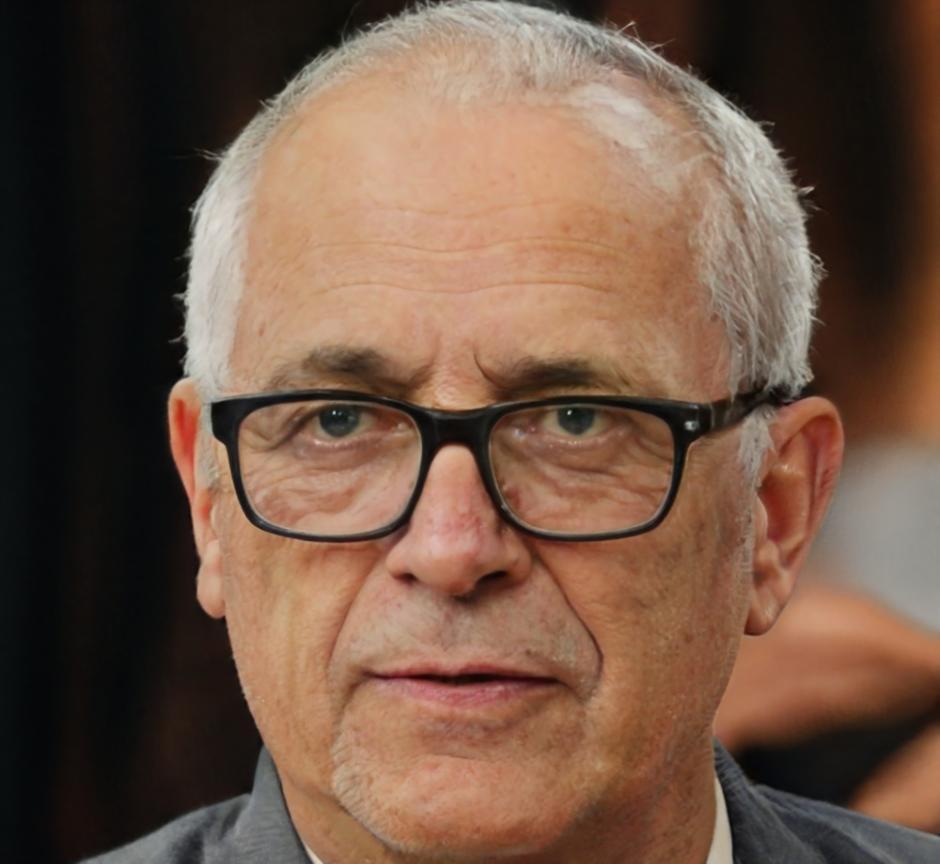

Henrik Lindqvist

Senior Industry Analyst

Henrik spent twelve years with mid-market advisory firms in Melbourne before joining us in early 2024. He's built financial models for manufacturing deals and mining operations. His sessions focus on reading between the lines of annual reports.

Siobhan Gallagher

Former CFO & Strategy Lead

Siobhan ran finance for a logistics company before shifting into consulting. She brings the perspective of someone who's presented to boards and worked through tight quarters. Her approach is practical and she doesn't sugarcoat the messy parts.

What Past Participants Tell Us

We track how people use what they learn. These numbers reflect feedback from participants who completed programs between mid-2024 and early 2025.

Applied Skills Within 3 Months

Most participants used frameworks from the program in their work shortly after finishing—whether for internal reports or client projects.

Average Weeks to Completion

Programs typically run 6 to 8 weeks, with evening sessions designed around full-time work schedules. Some stretch longer depending on group pace.

Would Recommend to Colleagues

Satisfaction scores from our post-program surveys show strong word-of-mouth. Many participants send teammates to later cohorts.

What You'll Actually Learn

Our curriculum focuses on building analytical judgment—not just technical skills. You'll work through real company data, industry comparisons, and scenario planning exercises.

Financial Statement Analysis

Reading income statements, balance sheets, and cash flow reports with a critical eye. You'll learn what red flags look like and how to spot trends that matter.

Industry Benchmarking

Comparing companies within sectors using ratios and operational metrics. We cover retail, resources, healthcare, and tech—industries with different dynamics and expectations.

Valuation Fundamentals

Understanding DCF models, multiples, and precedent transactions. You won't become a valuation expert in six weeks, but you'll know enough to follow the logic and ask smart questions.

Presenting Findings

Building decks and memos that communicate insights clearly. We spend time on structuring arguments and anticipating pushback—because analysis only matters if people understand it.